Introduction to Modern Payroll Management

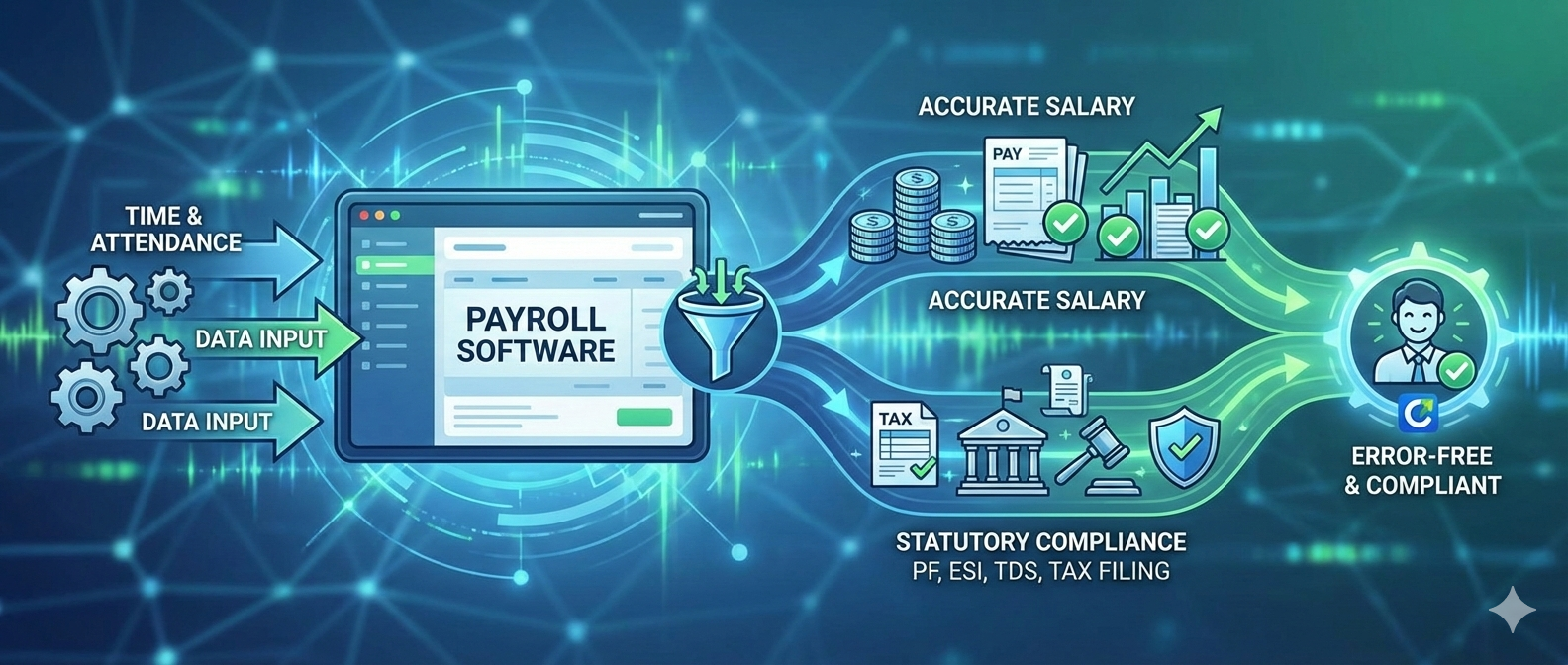

Payroll is not just about paying salaries. It’s about paying the right salary, at the right time, while following every legal rule. Sounds simple? In reality, payroll is one of the most complex and sensitive business operationsespecially in India.

With changing labor laws, multiple statutory requirements, and growing workforce diversity, manual payroll has become a ticking time bomb. This is where HR payroll software steps in as a lifesaver.

Let’s break down how modern payroll systems ensure salary accuracy and statutory compliance without headaches.

Why Payroll Accuracy Matters for Businesses

Think of payroll as the heartbeat of an organization. One wrong calculation and the entire system feels the shock.

Accurate payroll:

- Builds employee trust

- Prevents legal penalties

- Improves financial planning

- Enhances employer brand

A single error can lead to unhappy employees, compliance notices, or even audits. That’s why businesses today rely on automation rather than spreadsheets.

The Growing Complexity of Payroll in India

India’s payroll landscape is unique. Different salary structures, variable allowances, multiple statutory deductions, and frequent regulatory changes make payroll management extremely challenging.

Handling this manually is like trying to juggle knives one slip and things get messy.

Understanding Payroll Software

What Is HR Payroll Software?

HR payroll software is a digital system that automates salary processing, deductions, compliance, reporting, and payslip generation all in one place.

It acts like a super-organized accountant who never gets tired or makes calculation mistakes.

Evolution from Manual Payroll to Automation

Earlier, payroll meant registers, calculators, and Excel sheets. Today, automation has replaced guesswork with precision.

Manual payroll:

- Time-consuming

- Error-prone

- Difficult to audit

Automated payroll:

- Fast

- Accurate

- Fully compliant

Common Payroll Errors in Traditional Systems

Some frequent issues include:

- Incorrect salary calculations

- Missed statutory deductions

- Delayed salary payments

- Outdated compliance rules

Payroll software eliminates these problems at the root.

Role of HR Payroll Software in Salary Accuracy

Automated Salary Calculations

Payroll software calculates salaries automatically based on:

- Attendance

- Leaves

- Overtime

- Incentives

No manual input means no human errors. The system follows predefined formulas consistently every month.

Handling Allowances, Deductions, and Reimbursements

From HRA and bonuses to deductions and reimbursements, everything is calculated precisely.

Even complex salary structures are handled smoothly no confusion, no miscalculations.

Error Reduction Through Automation

Automation doesn’t get distracted. It doesn’t misread numbers. It doesn’t forget formulas.

That’s why payroll software reduces errors by a massive margin compared to manual methods.

HR and Payroll Software India: Designed for Local Compliance

India-Specific Payroll Challenges

India has:

- Central and state-level laws

- Multiple tax slabs

- Industry-specific rules

Generic systems often fail here. That’s why HR and payroll software India is designed specifically for local compliance needs.

Built-in Statutory Rules and Updates

Payroll software comes with pre-configured statutory rules that update automatically when laws change.

No need to track government notifications manually the system does it for you.

Central and State-Level Compliance Handling

Whether your employees are in one state or ten, payroll software applies the correct rules based on location.

This ensures 100% statutory accuracy across regions.

Statutory Compliance Explained

What Is Statutory Compliance in Payroll?

Statutory compliance means following all labor laws and regulations related to salary, taxes, and employee benefits.

It’s not optional it’s mandatory.

Key Payroll Laws and Regulations in India

Payroll compliance involves multiple regulations, including:

- Wage-related rules

- Tax deductions

- Employee benefit contributions

- Filing and reporting timelines

Missing even one can result in penalties.

Risks of Non-Compliance

Non-compliance can lead to:

- Heavy fines

- Legal notices

- Business reputation damage

- Operational disruptions

Payroll software acts as a compliance shield.

How Payroll Management Software India Ensures Compliance

Automatic Statutory Calculations

Payroll management software India calculates statutory deductions automatically based on latest rules.

No manual intervention. No outdated formulas.

Real-Time Compliance Updates

Whenever regulations change, the system updates itself.

This keeps your payroll always compliant without extra effort.

Audit-Ready Reports and Documentation

Payroll software generates structured reports that auditors love.

Everything is transparent, traceable, and ready when needed.

Best HR Payroll Software India for Error-Free Processing

Features That Ensure Accuracy

The best HR payroll software India includes:

- Automated calculations

- Built-in compliance logic

- Smart validations

Accuracy is built into the system not added later.

Built-in Validation Checks

Before processing payroll, the system checks for:

- Missing data

- Inconsistencies

- Compliance gaps

Errors are flagged before they cause damage.

Role-Based Access Controls

Only authorized users can make changes, reducing the risk of accidental or intentional errors.

Cloud Based HR Payroll Software: The Smart Advantage

What Is Cloud-Based Payroll Software?

Cloud based HR payroll software operates online, allowing secure access anytime, anywhere.

No local installations. No data loss.

Real-Time Access and Data Security

Cloud systems offer:

- Encrypted data

- Regular backups

- Controlled access

Your payroll data stays safe and accessible.

Scalability and Flexibility

As your business grows, cloud payroll grows with you without extra infrastructure costs.

Payroll Automation and Employee Trust

Transparent Payslips and Records

Employees can view detailed payslips anytime.

Transparency builds trust and trust builds retention.

On-Time Salary Disbursement

Automation ensures salaries are processed and paid on time, every time.

No delays. No excuses.

Reduced Payroll Queries

Accurate payroll means fewer employee complaints, saving HR time and effort.

Integration with HR Systems

Attendance, Leave, and Payroll Sync

Payroll software integrates seamlessly with attendance and leave systems.

No duplicate entries. No mismatches.

Performance and Incentive Integration

Incentives and bonuses flow directly into payroll automatically calculated and paid.

Single Source of Truth

All employee data lives in one system, ensuring consistency and accuracy.

Payroll Software and Compliance Reporting

Monthly, Quarterly, and Annual Reports

Payroll software generates compliance reports on demand ready for submission.

Easy Filing and Submission

Reports are formatted correctly, reducing filing errors and rework.

Data Accuracy During Audits

Audits become smooth when data is accurate and well-documented.

Cost and Time Savings Through Payroll Software

Reduced Manual Effort

HR teams save countless hours by automating payroll tasks.

Avoiding Penalties and Fines

Compliance accuracy means zero penalties saving money and stress.

Improved HR Productivity

HR can focus on people, not paperwork.

Future of Payroll Management in India

AI and Smart Payroll Systems

AI-driven payroll systems will predict errors before they happen.

Predictive Compliance and Analytics

Future payroll tools will forecast compliance risks and trends.

Employee Self-Service Evolution

Employees will have more control and visibility over their payroll data.

Choosing the Right Payroll Software

Key Factors to Consider

Look for:

- Compliance accuracy

- Automation features

- Scalability

Customization and Support

Your payroll system should adapt to your business not the other way around.

Long-Term Scalability

Choose a system that grows with your organization.

Common Myths About Payroll Software

Payroll Software Is Only for Large Companies

False. Small and mid-sized businesses benefit the most.

Automation Means Less Control

Actually, automation gives more control through visibility and accuracy.

Cloud Payroll Is Not Secure

Modern cloud systems are more secure than local setups.

Why Payroll Software Is No Longer Optional

In today’s compliance-driven world, payroll software is not a luxury, it’s a necessity.

From accurate salary processing to flawless statutory compliance, payroll automation protects your business, empowers HR, and builds employee trust.

If you want stress-free payroll, the answer is clear: automate it.

FAQs

- How does HR payroll software reduce salary errors?

By automating calculations and eliminating manual data entry. - Is payroll software suitable for Indian compliance?

Yes, especially systems designed for India’s statutory structure. - Can payroll software handle multiple salary structures?

Absolutely. It supports complex and customized salary components. - Does cloud based HR payroll software ensure data safety?

Yes, with encryption, backups, and controlled access. - How often are compliance rules updated in payroll software?

Updates are applied automatically whenever regulations change.

Leave a Reply